SCGI/OECD Swedish Capital Market Review

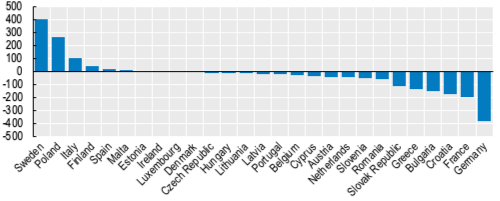

During the past 20 years, western economies have seen a decrease in the number of listed companies. The number of listed US companies has fallen by around 50% from 8000 in 1995 to around 4000 today, and most EU Member States are facing a similar decline (see figure below). There are multiple explanations for this development and commentators have pointed to overregulation, limited visibility of smaller companies, increased access to private equity and venture capital together with increased costs and exposure associated with being a listed company.

The Swedish market is however an exception. Our public equity market is the fastest growing equity market within the EU, and is currently the third largest EU-market by capitalisation and the largest by number of listed companies with just over 1000 companies at year-end 2023. Moreover, the corporate bond market has among the highest number of individual issuers in the EU and has grown rapidly during the past ten years. The Swedish private equity market is also exceptionally strong. In addition, Swedish industry is top-rated in most international comparisons on corporate governance standards, as well as sustainability.

New listings net of delistings in the EU-27, 2010–2022

Source: Swedish Capital Market Review

When public equity markets are shrinking in most countries outside of Asia, and there is little tangible knowledge on why markets experience this development, it is highly relevant to understand why Sweden has experienced the development described above for several reasons. First, the regulatory frameworks in Sweden are increasingly subject to EU regulation. The Commission’s growing ambition to harmonise corporate law and capital market regulation within the EU has generally not taken into consideration the Swedish and Nordic approach in the area, and more knowledge about the Swedish market and the drivers behind the positive development is needed. Second, vibrant European equity markets granting broad access to market-based sources of financing for European companies is “at the heart of the capital markets union” according to the CMU 2020 action plan, and it will also be important to highlight the central role of deep, complete and well-functioning capital markets in providing financing for the many important challenges that the business sector is now ready to take on. Examples include the need for investment in the energy sector to mitigate climate change and the development of the next generation of digitalisation, including artificial intelligence. Better understanding of well-functioning markets would be helpful. Third, a deep and well-functioning capital market is an important prerequisite for ordinary households to, directly or indirectly, participate in corporate wealth creation. It also provides them with a wider array of opportunities to diversify and monitor their long-term savings, including for retirement, as institutional investors will be able to develop and provide suitable products. A better understanding of the drivers of the current market development in Sweden would be helpful in future regulation (both state and self-regulation), partially to know what regulatory actions not to take, and partially to better understand the weaknesses, challenges, and threats to the market to know what areas and behaviours (current and future) that should be target of regulation. This is not only to prevent abusive behaviour, but also to enable innovation in market driven practices and solutions.

For these reasons, the SCGI has set up a six-year research programme – the Swedish Capital Market Review, in collaboration with the OECD with a focus to describe and understand the Swedish capital market and its drivers, aiming to inform the corporate governance debate and public policy within Sweden and the EU about its status, strengths, and weaknesses. The program was initiated in January 2023.

SCGI and the OECD have so far published three reports – two on the Swedish corporate bond market; The Swedish Corporate Bond Market and Bondholder Rights, The Swedish Corporate Bond market: Challenges and Policy Recommendations, and one on the Swedish equity market: The Swedish Equity Market: Institutional Frameworks and Trends. All three can be found under publications here on the website and below.

For questions regarding the project, contact Erik Lidman.

29 April 2025

The Swedish Equity Market: Institutional Frameworks and Trends

Sweden has one of the largest and most active equity markets in the European Union. Small companies use public markets to a much larger extent than in comparable countries and the level of household engagement in domestic capital markets is high. This report assesses the Swedish equity market, drawing from original data and in-depth interviews with market participants. It also discusses the policy initiatives that have promoted the growth of the Swedish market, including the local regulatory and corporate governance models. The report is available here.

OECD

4 April 2024

The Swedish Corporate Bond Market: Challenges and Policy Recommendations

This report provides an assessment of the Swedish corporate bond market and policy recommendations to improve its functioning, drawing from detailed empirical analysis and in-depth interviews with market participants. It includes two empirical chapters which provide insights into the market’s evolution over the last two decades based on original data, emphasising changes since the 2008 financial crisis with respect to market size, issuer characteristics, credit quality, industry composition and investor universe. These developments are also considered in an international context, comparing the Swedish market with selected peer countries, both in Europe and elsewhere. The report is available here.

OECD

14 October 2022

The Swedish Corporate Bond Market and Bondholder Rights

This report provides a detailed account of the Swedish corporate bond market. Based on original data, it offers an overview of how the market has developed in the past two decades with respect to, among other things, size, issuer characteristics, risk profile and liquidity. In particular, it documents how the market has changed since the 2008 financial crisis and explores the increasingly important role of real estate companies in the local bond market. It also offers a comparison of the Swedish market with selected peer countries (European and non-European), both in terms of market structure and relevant regulation. The report is available here.

OECD

Contact

Erik Lidman

Email: erik.lidman@juridicum.su.se